IRS 13844 2020 free printable template

Get, Create, Make and Sign

Editing irs form 13844 online

IRS 13844 Form Versions

How to fill out irs form 13844 2020

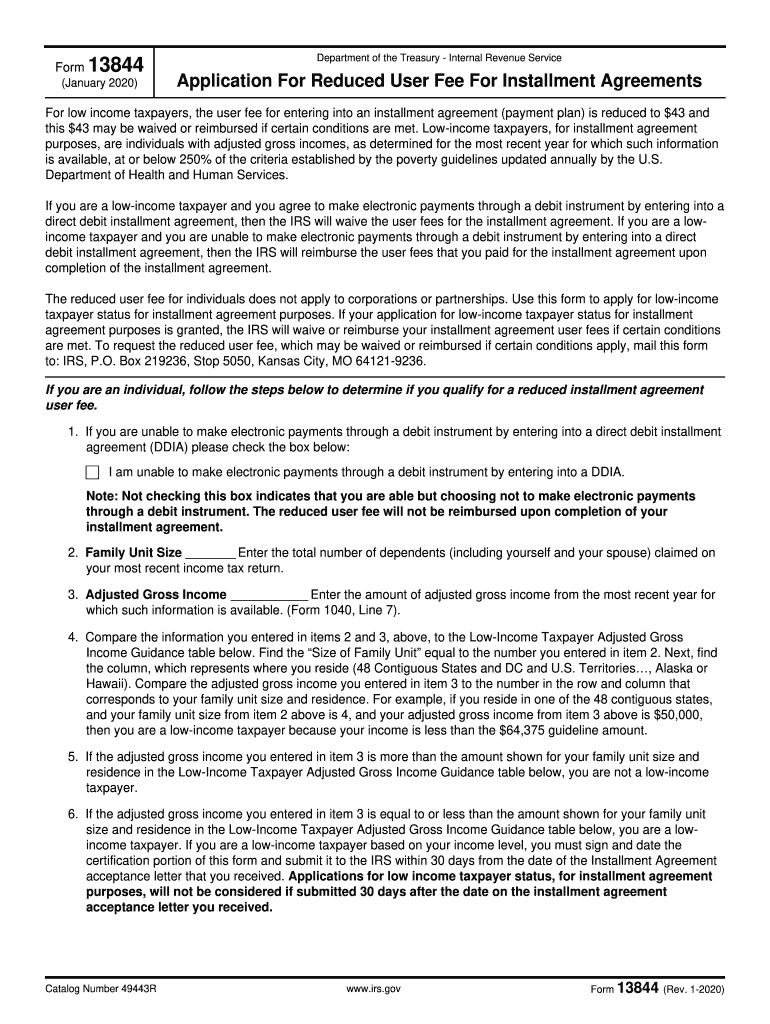

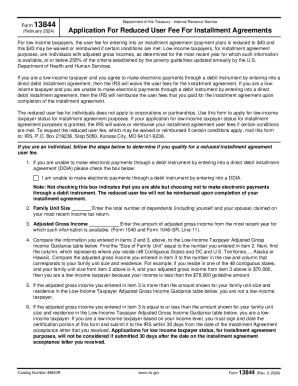

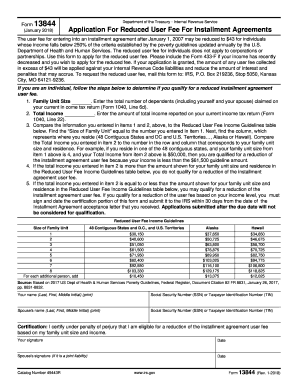

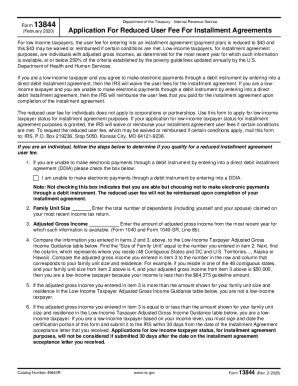

How to fill out IRS Form 13844:

Who needs IRS Form 13844:

Video instructions and help with filling out and completing irs form 13844

Instructions and Help about irs gov form 13844

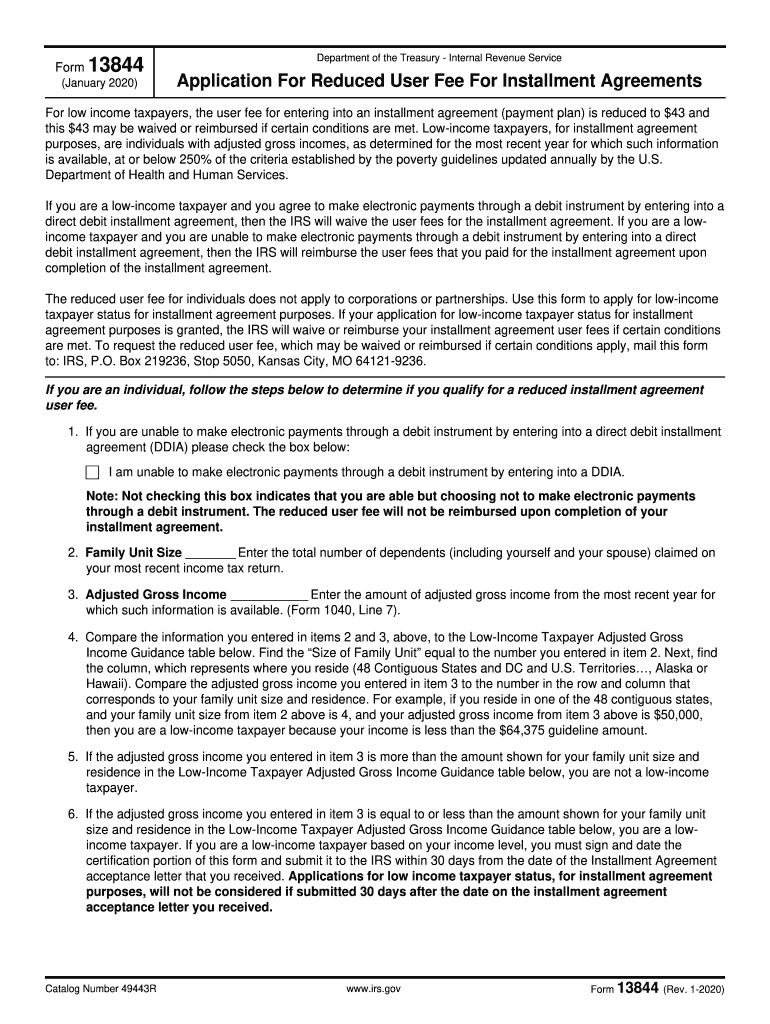

Music today we're talking about IRS form 9465 installment agreement request form this is a pretty simple form, but we've got a few pointers for you that will make filling out the 9465 even easier tip number one what is IRS form 9465 and when should I use it IRS form 9465 is a collections form meaning it's only useful if your client knows back taxes to the IRS specifically form 9465 is used when setting up an installment agreement or payment plan on behalf of your client however there are several reasons that you should not use the form 9465 even when setting up an installment agreement for a client if your client owes less than 50000 don't use the 9465 instead use the IRS a--'s online payment agreement tool sometimes called OPA for a faster smoother experience if your client currently owns a business don't use the 9465 potential complications such as overdue payroll taxes are more than the 9465 is designed to handle instead get in contact with the IRS, and they'll get you started filling out a form for 33d in other words if your client has a tax debt of more than 50000 and doesn't own a business form 9465 is the right installment agreement form for you tip number 2 ditch the pen one of the most surefire ways to get any form rejected is to submit something illegible IRS employees don't have time to try to figure out if you wrote a 1 or a 7 and if they can't read it they're likely to reject it even if you don't use software like canopy to automatically fill out your 9465 all the forms are on the IRS website, and they're editable PDFs that you can fill out right in your browser no software required tip number 3 how much do you put on line 11 a most of the fields on the 9465 are self-explanatory and don't require any explanation however line 11a instructs you to enter the amount you can pay each month which means you have a choice to make how much option number one is the minimum the IRS sets the sort of minimum monthly payment at the tax debt divided by 72 so if your client owes sixty-four thousand eight hundred dollars the minimum monthly payment would be nine hundred dollars option number two more than the minimum the IRS doesn't mind if your client pays off their debt in less than 72 months in fact they like it a lot if your client has the ability paying more than the minimum will not only clear their debt faster but will help reduce the amount your client will have to pay in penalties and interest in addition to their debt option number three less than the minimum it's not ideal, but the IRS will still grant an installment agreement even if the most your client can pay is less than their debt divided by 72 however you will need to submit a collections' information statement form 433 F along with the 9465 so let's recap use form 9465 to set up an installment agreement for a client who owes more than 50000 and doesn't own a business your form should always be easy to read if you don't use software to automatically fill out your 9465 use your...

Fill 13844 form irs : Try Risk Free

People Also Ask about irs form 13844

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs form 13844 2020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.